- Homepage

- Insurance Solutions

- Cargo

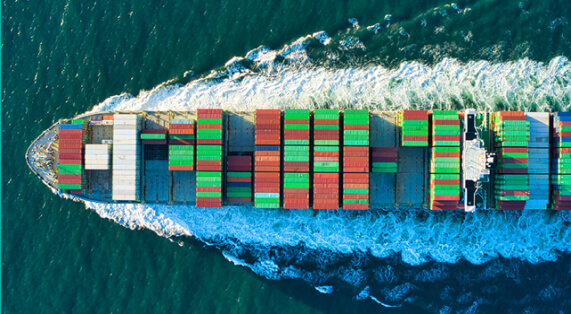

Cargo

What is it for

No matter how well the transportation logistic is organized, it is impossible to avoid all accidents in the process of cargo transportation. These incidents occur and can cause significant financial damage.

Cargo insurance allows to compensate for losses from damage, destruction or loss of your or your customers’ cargo, for which you are liable.

Best of GARDIA:

Efficiency

in resolving issues

in resolving issues

Constant

feedback

feedback

Individual

approach

approach

Prompt

response

response

FAQ

How to decide whether to purchase one-off policy or a general cargo insurance policy?

In the case of a small number of transportations, it is more reasonable to buy one-off cargo insurance policies for each shipment. For a larger number of shipments, it is more efficient to purchase insurance coverage on the basis of a General Cargo Insurance policy, which provides coverage for shipments defined under it on the agreed terms for a certain period of time (usually on an annual basis).

What is the difference between cargo insurance and carrier/forwarder liability insurance?

These are two different types of insurance, with different insurance objects and conditions. Cargo insurance protects the interests of the cargo owner and provides insurance coverage for the cargo itself. Carrier's or freight forwarder's liability insurance in terms of responsibility for the cargo safety is insurance coverage of risks associated with the carrier's or freight forwarder's fulfillment of their obligations to the customer (cargo owner) under the law or under the contract, meaning that it is liability insurance. Thus, the carrier/freight forwarder will be obliged to compensate for the loss of the cargo only in cases where his liability (which is established by law) occurs.

What are the ways of insurance premium payment?

• The minimum deposit is payable immediately or in installments, which is determined on a contract-by-contract basis. The minimum insurance premium is calculated on the basis of the declared cargo turnover and is subject to recalculation in accordance with the insurance premium rates specified in the contract at the end or during the insurance period. The payment is based on monthly or quarterly actual shipment declarations. The payment based on the fact of each shipment. The payment based on the fact of each declared shipment. As a rule, it is used in case of a small number of large shipments.

What is the covered insurance period?

Insurance does not generally cover claims for incidents occurring prior to the inception of the insurance period. If necessary, retroactive coverage can usually be provided at an additional premium.